Many foreigners haven’t yet understood the Japanese salary system properly, so when the salary is transferred to their account, they are surprised to find out that it is less than what they were expecting to receive. That is why I will explain in detail the following guideline and, also, the calculation method.

Contents

The salary system that everyone who works must know

Salary can be obtained as compensation for labor and for contributing to the company. It is an indispensable asset for living. If it is a fixed salary such as a monthly salary, it is a very important indicator that determines the standard of living of every month. However, if you get a lower amount than the salary you thought it would be before you joined the company, you will be shocked. To prevent such a situation, deepening the knowledge into the salary system should be helpful for starting to work comfortably when changing jobs.

What is Salary After Tax Income?

In Japan, the amount of money that is actually transferred to a designated bank account is called the “After-Tax Income”. This is the total salary paid by the company minus social insurance premiums and taxes. People who don’t know the details will feel that it is “less than what they expected …”.

What does “After-Tax” mean?

Actual income that you receive= “After-Tax”, but there are various breakdowns in salary. It is referred to the amount of money deducted from premiums such as company insurance premiums, pension and taxes such as income tax and resident tax from the face value provided by the company, like base salary (hourly wage, daily wage, monthly salary), paid overtime and company’s allowance.

About “Face Value” and “Deduction”

Rather than knowing the amount of money after-tax, what is important to know is the “face value (total payment)” and the “deduction” amount. By gaining knowledge about face value and deductions, you can improve your understanding of how your income is determined.

The details are as follows.

The “face value” is the total amount paid by the company

There are various face value breakdowns. This should be noted because there are differences between companies.

(1)Basic salary

This is the basic amount for which the amount of payment is determined, such as hourly, daily, and monthly wages. This basic salary does not include incentives such as overtime, allowances, and commissions.

(2)Overtime allowance

An allowance that exceeds the business hours (working hours) determined by each company or that exceeds the legal working hours of 8 hours a day, 40 hours a week (an increase of 25% or more from the hourly wage). In other words, paid overtime.

(3)Late Overtime allowance

The allowance paid when working overtime after 22:00 (over 25% from the hourly wage) or working on holidays (over 35% over the hourly wage) among overtime exceeding the business hours.

(4)Qualification allowance

Allowance paid to professionals and other persons who have the qualifications required for the business specified by the company. In some cases, the amount varies depending on the level of difficulty in obtaining national qualifications.

(5)Executive allowance

Generally, it is paid to those who are promoted and move to managerial positions. In most cases, the amount varies depending on the position, chief, director or general manager.

(6)Commuting allowance

Allowance for subsidizing a full or fixed amount of transportation expenses for those who commute using transportation such as trains and buses. Some companies may pay gasoline to those commuting by car.

In addition to these, there are many peculiar benefits like family allowances paid as a subsidy for employees with dependents, housing allowances to support housing expenses such as rent and mortgages, and business allowances for companies with business trips.

“Deduction” is the total amount deducted from salary

“Deduction” is calculated from half of the total amount of social insurance, such as insurance premiums and pensions, resident tax and income tax are deducted from salary. Excluding income tax, the amount will not change for the first year after the amount is determined.

(1)Health insurance

This is a national medical insurance policy that allows you to visit a medical institution if you are ill or injured. The insurance premium will be halved with the employer. Also, the insurance premium rate will vary depending on the health insurance association you are registered.

(2)Employment insurance

It is widely recognized as an insurance policy that provides unemployment benefits in the event of unemployment, even though there are various benefits. The insurance premium rate will depend on the company’s business.

(3)Nursing insurance

With insurance that requires participation when the target age is over 40, you can receive welfare services at 10-20% when you need nursing care.

(4)Employee’s Pension

This is a system in which the participant himself / herself and the employer pay half the price and pay a premium to receive pension payments.

(5)Income tax

This tax is imposed on the income earned by an individual for a year, and the tax rate varies depending on the annual income. If you work for a company, it will be deducted by “withholding” and settled by “year-end adjustment or final tax return”.

(6)Resident tax

This tax is paid to the prefecture or municipality where the worker resides. The amount is determined by the annual income of the previous year.

In addition, there are cases where labor union fees, retirement reserves, company housing, etc. are deducted.

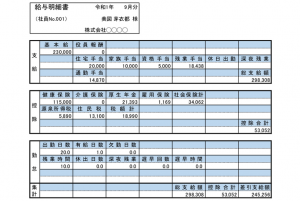

Let’s actually take a look at the salary details

It is easier to understand when you see the actual salary details, rather than just checking the amount of the salary after-tax. The details and item names of the pay slip may differ depending on the company, but in general, the amount indicated in the item “Amount of deduction” is the “withholding amount”.

What is the guideline for after-tax income?

I’ve told you in detail about “face value” and “deduction”. But, if before joining the company you know the salary listed on the job offer information, you can get a clue of the amount of after-tax income. So, from here, I will explain how to get the amount of money that will serve you as a standard.

What percentage of face value can you receive as an after-tax income?

An approximate standard is 80% (75-85%) of the face value is the “after-tax income”. However, the percentage varies depending on the person even at the same face value. For example, the amount of deductions varies depending on the previous year’s annual income and the number of dependents. Besides, the higher the face value, the higher the income tax rate. If it exceeds approximately 600,000 yen/a month, the percentage of the after-tax income will fall below 75%.

Example of tax exemption for dependents between a single person and someone with dependents.

In the case of a single person, if the monthly salary is 250,000 yen, about 80%, ¥197,690 will be the net income. In the case of a married couple with two dependents, you can receive a “dependence deduction” that is preferentially paid by income tax/resident tax. ¥ 200,430 will be the net income, which is an increase of ¥ 9000.

What is the calculation method?

As I mentioned earlier, about 80% of the face value is taken. In other words, as a calculation method, you can calculate the approximate take-up amount by multiplying the face value by 0.8.

* Please note that the amount of income may change in conjunction with the deduction total depending on income tax and dependents.

How to accurately calculate salary after-tax income

f you know the face value (total amount of payment) and the breakdown of deductions, you can easily derive the exact proceeds. The calculation method is [basic salary + fixed allowance + variable allowance (other than bonus)]-[social insurance premiums (health insurance, long-term care insurance, welfare pension, employment insurance)]-[tax (income tax, resident tax)]. By following those steps, you can calculate it.

How to derive an approximate amount from a bonus

Some companies offer bonuses twice a year or once a year. For that bonus, you can calculate the approximate take-up amount at approximately 82% of the face value. For example, if a single person with a basic salary (monthly salary) of 220,000 yen gets a 660,000 yen bonus for three months, the proceeds will be approximately 540,000 yen. This also applies to your case, as the percentage of net income varies depending on the total deductions.

Important points when changing jobs

During your career change period, you will see a variety of job offers. In that case, it is very important to pay attention to the net amount. If you make don’t get it right, your income may be lower than your previous job. Be sure to check prior information and to get a deeper knowledge of it, to find a company that meets your needs.

The salary in the job offers is not the net income.

Most salaries listed in job listings and job sites in Japan will show the “face value”. In other words, the net income you will receive as a salary will be less than the amount listed there. Therefore, if you are looking for a place where you can change your salary to a better than the previous job (the current job at the time of job change), you can compare the face value or multiply the salary listed in the job offer information by 0.8 to calculate the approximate net income. Let’s consider it after that.

Tell the face value of the desired salary instead of the net amount.

There are cases where the salary changes depending on the job seeker’s experience and ability, such as “monthly salary of over ~” or “monthly salary of ¥ xxx to ¥ xxx”. Be sure to tell the face value when you are asked about your desired salary. If you tell the net income, the recruiter will think of it as the face value and you will have a lower income than the one you wanted. Let’s confirm the desired salary with face value so you don’t regret it after joining the company.

Conclusion

Even if you meet a good company or job as your next destination, you will not be able to improve your life if your salary is less than expected. To prevent this from happening, it is very important to know the “after-tax income amount” which is the money you will have at hand. Acquire the knowledge to determine the correct salary for each opportunity, regardless of the face value amount listed in the employment information, and use it for future job change activities.