Foreigners working in Japan will be enrolled in the Japanese social insurance system. If you do not pay insurance premiums according to the law, you may suffer disadvantages like high treatment costs when you get sick. Also, foreigners who already work in Japan and are planning to change jobs should be careful. If you do not complete the procedure within the specified period, there is a risk of not being able to receive the coverage or losing money.

This time, we will explain the Japanese social insurance system for foreigners who are looking to work in Japan and foreigners who are looking to change jobs in Japan.

Contents

Do Foreigners Have to Join the Japanese Social Insurance?

As a general rule, foreigners must join social insurance in Japan regardless of nationality. There are five types of social insurance in Japan: pension insurance, medical insurance (health insurance), worker’s accident insurance, unemployment insurance, and long-term care insurance.

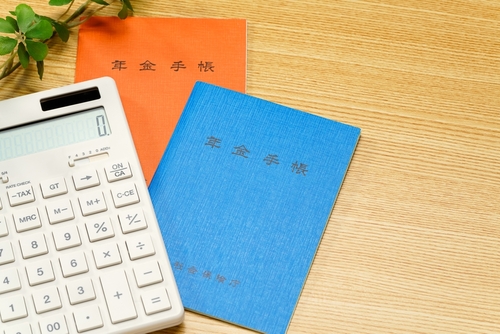

Pension insurance

Annuity insurance is a mechanism in which the premiums paid by the working generation are paid to seniors aged 65 and over. There are two types of pension insurance in Japan: The National Pension and the Employees’ Pension. The national pension is obligatory for all people in Japan who are 20 to 60 years old, and foreigners are no exception. The Employees’ Pension is a pension that company employees and government employees join in addition to the national pension. Employees’ pension insurance is deducted from their monthly salary, but the company pays half.

However, from the perspective of a foreign worker, there are some concerns like “Since I also have a pension in my home country, it is too expensive to also join insurance in Japan” or “What will happen to my paid insurance if I go back to my country?”. The Social Security Agreement and the lump-sum withdrawal system have been set up to solve such concerns of foreigners.

What is a social security agreement?

For foreigners who have a pension in their home country, having a pension in Japan means paying double premiums. Also, in order to receive a pension in Japan, you have to join the pension for a certain period, so there is a risk that insurance premiums won’t be refundable.

The “Social Security Agreement” is established to avoid such disadvantages. The social security agreement is a system that allows foreigners from countries that have signed a social security agreement with Japan to join a pension in either Japan or their home country, depending on how long they work in Japan.

>> Click here for details on social security agreements

What is lump-sum withdrawal?

The lump-sum withdrawal is a system that allows a foreigner who has joined the Employees’ Pension and National Pension to receive a certain amount of money in case they return to their home country before they receive their pension.

>> Click here for details of withdrawal lump sum

Medical insurance (health insurance)

Medical insurance (health insurance) is a system that supports the burden of medical expenses throughout society. By joining the medical insurance, the burden of medical expenses will be reduced when you get ill or injured or when you visit a medical institution.

The term “health insurance” generally refers to the health insurance that employees join, and foreign workers are obliged to join as well as Japanese workers. Insurance premiums are deducted from the monthly salary, but the company pays half.

On the other hand, “National Health Insurance” is for non-employees such as self-employed persons and full-time housewives. Foreigners also need to join the National Health Insurance if they stay in Japan for more than 3 months. Also, pay the full amount of the insurance premium, and the amount varies depending on the municipality where you live.

Worker’s accident compensation insurance

Worker’s accident compensation insurance is a system in which an employee’s insurance benefits are paid if during work or commuting, a worker suffers injury, disease, disability or death resulting from employment-related cause.

Foreign workers are required to join the work-related accident insurance as well as Japanese workers. There is no employee burden because the company bears the full amount of the insurance premium for the workers’ accident compensation insurance.

Unemployment insurance

Unemployment insurance is a system that provides the benefits necessary to promote the reemployment of employees while stabilizing their lives in the event of unemployment. The so-called “unemployment allowance” is paid by the employment insurance.

As long as the conditions of “a person who is expected to continue to be employed for 31 days or more” and “a prescribed working time of one week is 20 hours or more” are satisfied, foreign workers will be covered by employment insurance in the same way as Japanese workers. It is necessary to subscribe to. The insurance premium for employment insurance is deducted from the monthly salary, but the company pays part of it.

Long-term care insurance

Long-term care insurance is a system that supports the elderly who need long-term care throughout society. Those who are 40 years old or older and under 65 years old and have medical insurance or 65 years old or older are obliged to join, and foreigners are no exception.

Care insurance premiums must be paid from the age of 40 and are collected along with medical insurance (health insurance) premiums. If you are a company employee, you will be deducted from your monthly salary, but the company will pay half of it. Non-employees must be paid to the local government where they live together with the national health insurance premium.

Social Insurance Procedures When Changing Jobs in Japan

If you are already working in Japan and wish to change jobs in Japan, you will need to apply for social insurance.

If you have no retirement period and you work for a new job immediately, the job transfer will do most of the work for you. On the other hand, if there is a period of separation, you need to be careful as there are procedures that you must perform yourself.

Procedures required for pension insurance

In case you change jobs immediately, you only need to submit your pension handbook to your next employer. The person in charge will do the procedure.

If case you leave or lose your job, you will need to switch from the Employees’ Pension to the National Pension. Within 14 days from the next day of retirement, please complete the procedure at the local municipal office (city / town / village office).

Procedures required for medical insurance (health insurance)

If you want to change jobs immediately, you will need to join a health insurance at the job change location, but the person in charge in your new company will do the procedure.

If an unemployment period occurs, it is either “discretionary continuation” or “subscription to the National Health Insurance”. As a general rule, if you leave a company, you lose the insured certificate of the health insurance you were in that company, but if you meet certain conditions, you will join the same health insurance for two years after you leave the company. Can continue (optional continuation). The procedure for voluntary continuation is to be submitted to the health insurance association that you have joined within 20 days from the day after your retirement date.

If you do not continue voluntarily, you will have to join National Health Insurance. Apply for National Health Insurance at the municipal office where you live within 14 days from the day following your retirement.

Procedures required for worker’s accident compensation insurance

If you want to change jobs immediately, you will have to join the worker’s accident compensation accident insurance at the job change destination, but the person in charge in your new company will do the procedure. Also, if you have a job separation period, you do not have to take any special procedures because you will not be enrolled in the workers’ compensation insurance during the job separation period.

Procedures required for unemployment insurance

If you want to change jobs immediately, just submit the employment insurance card and turnover slip you received from the company you quit to the new company. The person in charge will do the procedure.

If there is a turnover period, you may be able to receive a so-called “unemployment allowance”. In that case, please contact Hello Work (a Japanese government employment agency) that has jurisdiction over the local government where you live.

Procedures required for long-term care insurance

Since long-term care insurance is integrated with medical insurance (health insurance), it is OK if the necessary procedures for medical insurance (health insurance) are performed.

Conclusion

Foreign workers are also covered by Japanese social insurance, so you can enjoy the benefits of social insurance in the same way as Japanese workers. Of course, this requires payment of insurance premiums. In order to work in Japan with peace of mind, make sure you understand the basic social insurance system and pay the insurance premium properly.

Also, if a foreign worker who is already working in Japan quits the company and is leaving for a certain period of time, there are procedures to be performed by himself. Medical insurance (health insurance) and unemployment insurance (unemployment allowance) can make a big impact on your life while you are away from work, so be sure to the take steps to avoid any adverse situations.